Understanding the Importance of the Customs Weekly List of Unentered Goods

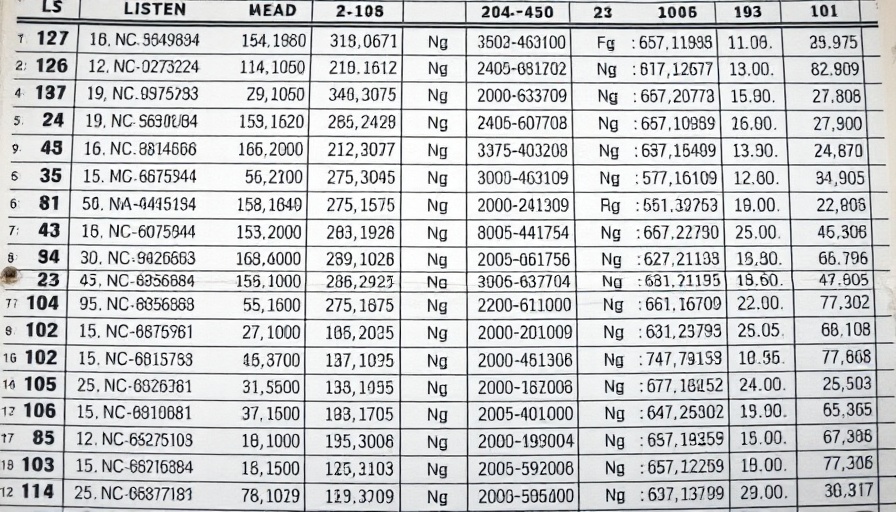

On February 17, 2025, the South African Revenue Service (SARS) published its Customs Weekly List of Unentered Goods, a critical communication piece that serves various stakeholders including importers, exporters, and potential bidders. The list not only informs interested parties that certain goods have been held in state warehouses but also warns of impending disposal actions if these goods are not claimed and properly entered. The repercussions of failing to act on this list can be costly, as it ultimately leads to the abandonment of unentered goods, underscoring the necessity for all parties engaged in import and export activities to stay vigilant and informed.

The Role of State Warehouses

State warehouses play a vital role in the Customs process, functioning as secure facilities where unentered, undeclared, or seized goods are stored. Managed directly by customs authorities, these warehouses are pivotal in both protecting the financial interests of the state by ensuring that due duties and value-added tax are collected, and providing a controlled environment for the handling of possibly contentious or non-compliant goods. The guidelines governing the access to and release of goods from these warehouses are stipulated by the Customs & Excise Act, which aims to encourage compliance from all market participants.

Potential Outcomes of Inaction

If goods listed in the Customs Weekly List remain unentered for an extended period, they may face disposal via public auction or other means, eroding potential profits for rightful owners and creating complications in the supply chain. The legal frameworks governing unentered goods necessitate that importers actively monitor these listings and react promptly to avoid dire consequences. This aspect emphasizes the heightened responsibility that comes with international trade.

Mitigating Risk Through Compliance and Engagement

In this fast-paced environment, maintaining compliance with customs regulations is more critical than ever. For businesses involved in importation, understanding and adhering to the stipulations surrounding unentered goods can shield them from legal repercussions and optimize their operational efficiency. Furthermore, integrating a proactive engagement strategy with customs authorities can facilitate smoother transactions and potentially lead to benefits like expedited processing and fewer penalties.

Future Trends in Customs Operations

As global trade continues to evolve, so too will the mechanisms through which customs operations are conducted. Increased digitalization promises to streamline customs processes, potentially reducing the incidence of unentered goods by enhancing communication and compliance monitoring. Automation and digital platforms can provide real-time updates and alerts about the status of goods, enabling stakeholders to respond swiftly and effectively.

Conclusion: Empowering Stakeholders for Success

Awareness and understanding of the Customs Weekly List of Unentered Goods is paramount for stakeholders in the import-export arena. By staying informed, actively engaging with customs regulations, and leveraging technological advancements, businesses can navigate the complexities of international trade with greater assurance. It is crucial for all participants to not only acknowledge the importance of these communications but also to take actionable steps towards compliance to safeguard their interests.

Add Row

Add Row  Add

Add

Write A Comment