DA's Bold Stance Against VAT Hike: A Move for the People

In a significant show of resistance, the Democratic Alliance (DA) has pledged to challenge the proposed value-added tax (VAT) hike through legal avenues. This action underscores a growing divide among South Africa's political parties, especially in an election year, where policy decisions directly impact the everyday lives of citizens. The Government of National Unity (GNU), comprising the African National Congress (ANC) and several smaller parties including the Economic Freedom Fighters (EFF), faces scrutiny as citizens reel from the potential financial burden.

Understanding the Political Landscape

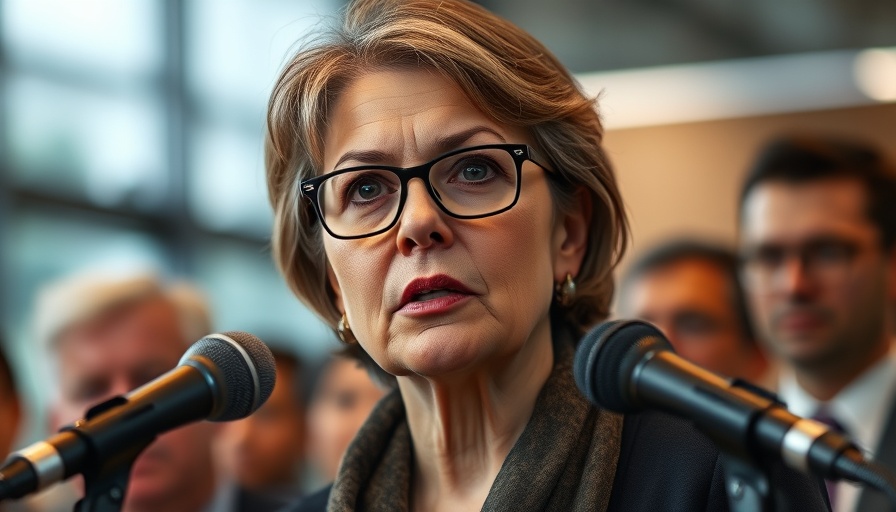

The landscape leading to this clash is characterized by heightened tension among the coalition government partners. Particularly, the DA, led by John Steenhuisen, champions fiscal policies that they argue would better serve the middle and lower-income sectors. In contrast, the government’s proposed VAT increase aims to shore up the national budget baffled by years of state capture and mismanagement—a legacy of former president Jacob Zuma.

Impact on Voter Sentiment Ahead of Elections

As we approach the 2024 general elections, how this VAT hike affects voter turnout remains a crucial question. Economic policies, such as taxes and social grants, could sway public perception. In a country grappling with income inequality and rampant youth unemployment, failures in service delivery could lead to a shift in allegiances among disenfranchised voters if the DA successfully markets this legal challenge as a defense of their interests.

Counterarguments and Diverse Perspectives

Critics argue that the DA's opposition may merely serve as a strategic distraction. They claim tax increases are essential for funding critical public services—including the National Health Insurance (NHI), reforms in education, and infrastructural improvements. Supporters of the ANC claim that hindrances to proposed reforms could cripple the country’s recovery efforts, igniting debates within the political framework surrounding public sector reform and anti-corruption measures.

The Bigger Picture: Electoral Reform and Future Trends

As political parties navigate this precarious terrain, questions surrounding electoral reform become increasingly pressing. Observations in the political circle point towards potential political realignment, especially if the DA's challenge leads to a tangible shift in voter outlook. Furthermore, the implications of constitutional amendments may arise if opposition parties unite under shared goals to prevent similar tax hikes in the future.

A Call for Citizen Engagement

The current VAT situation is a call to action for citizens to engage with their local representatives and demand transparency in governance. Previous discussions surrounding racial reconciliation highlight the importance of a unified approach in confronting socioeconomic disparities. Civil society engagement could leverage this momentum to promote grassroots movements against fiscal policies that disproportionately disadvantage the working class.

Conclusion: The Future of South Africa's Governance

As we witness the unfolding of this legal battle, it is critical for citizens to understand the implications of this VAT hike beyond economics; it speaks to executive accountability and the importance of parliamentary oversight in safeguarding public welfare. Following these developments is paramount for voters, as they set the stage for critical decisions impacting the future governance of South Africa. The DA's challenge may not only reflect a repudiation of proposed tax measures but may also signify a broader struggle for social justice.

Call to Action: Stay informed about the evolving political landscape and participate in discussions around governance and economic policy reforms. Your engagement can shape the policies that directly impact your community. Sign up for newsletters or attend local forums to voice your opinions.

Add Row

Add Row  Add

Add

Write A Comment